What Loan fits You

As one of Arizona's best mortgage lenders, Starboard Financial offers a variety of financing options. If you would like to discuss loan options, refinancing, or if you have general inquiries about the homebuying experience, Contact Us today to speak with a mortgage loan officer. If you do not have any questions and are ready to submit your information for a loan decision, please apply now.

Feeling Overwhelmed?

PURCHASE

OPTIONS

Select A Loan That Fits You

Need Help Finding The Right Loan?

When you are on the market for a loan, it is important to consider your options. When you choose Starboard Financial, we work with home buyers to get the most out of our mortgage products. Homebuyers get a mortgage loan officer to work with, and a real estate agent if they don’t already have one, to help them deduce which type of loan is the best fit. Our Starboard Financial mortgage loan officers will make sure all of your needs and questions are met, and they will help you with the loan process every step of the way.

Conventional home Loan

Conventional Loans are classified as conforming or non-conforming. Conforming simply means that the loan meets Fannie Mae and Freddie Mac’s established underwriting guidelines. If a mortgage loan does not fall within these guidelines, it is considered a non-conforming loan.

The main factor that determines whether a loan is conforming eligible is the loan amount. The maximum conforming loan amount is $453,100 in most states. Mortgages with loan amounts above this limit are considered Jumbo mortgages. Jumbo loans are still offered through Fannie Mae and Freddie Mac, but they are treated with different underwriting guidelines than conventional mortgages. Higher interest rates are common for non-conforming Jumbo loans because they carry higher risks.

Fixed or adjustable-rate mortgage (ARM) structures are available for Conventional loans. Fixed rate mortgages maintain the same rate and payment, subject to temporary mortgage insurance if applicable, throughout the life of the loan. The most common fixed-rate mortgages typically carry 15- or 30- year repayment terms. An ARM maintains the starting interest rate for a portion of the repayment term and then adjusts based on interest rate market conditions subject to the option selected.

Conventional mortgages require a minimum 5% down payment in most cases, whereas government loan types require a minimum 3.5% down payment or less. You will also be required to include monthly PMI in your payment if you put less than 20% down on your loan. PMI stands for Private Mortgage Insurance and in short, PMI protects your lender against a complete loss of money if you default on your mortgage payments.

Benefits of a

Conventional Mortgage

- Lower Monthly Loan Payments

- Lower Fees and Costs at Closing

- Mortgage Insurance not Required with 20% Down Payment

- Investment Property Types Eligible

- Less Stipulations for Selling or Refinancing on Loan Options

- Less Stringent Collateral (Property) Guidelines

FHA Home Loan

An FHA mortgage is fully insured by the Federal Housing Administration under the U.S. Department of Housing and Urban Development (HUD). The main initiative of an FHA government loan is to lower the barrier to entry of home ownership by decreasing up-front financing costs. Approved FHA lenders, such as Starboard Financial, are able to offer lower down payments for these loans because there is less risk due to the government insurance.

Credit qualification guidelines are often easier than other underwriting standards to allow more people access to the program. This benefit does not come without limitations, as availability is subject to income and primary residency restrictions. FHA loan amounts are subject to ceilings as well. FHA loans are eligible for both refinance and purchase transactions.

Benefits of an FHA

- Low Down Payments – as little as 3.5%

- 100% of Down Payment available from a gift

- Higher Debt-to-Income Ratios available in most cases

- Lower Credit Score Loan Options

- Waiting Periods for FHA Loan Less Following Bankruptcy, Foreclosure, or Short Sale

- Reduced Documentation on FHA Streamline Refinances

USDA Loans

One of the main initiatives of the USDA Rural Housing and Development program is to provide loan options in areas where mortgage lending is scarce.

USDA loans are guaranteed by the United State Department of Agriculture, so lower and moderate income earners, Native American tribal governments, the elderly, and people with disabilities can maintain financing options in their communities. The USDA and their partners work with many other federal initiatives to provide housing and employment to rural communities as well.

Borrowers of USDA loans are eligible to contribute as little as $0 for their down payment. Asset reserve requirements tend to be less strict than conventional loan standards. Annual household income limits apply based on the USDA regional charts. You can view the income and property requirements here:

Benefits of a

USDA Loan

- As little as Zero Down Payment Available

- Minimal Reserve Assets Requirement

- Loan Program not Restricted to First Time Home-Buyers

- Up-Front Guarantee Fee may be Financed

REFINANCE

OPTIONS

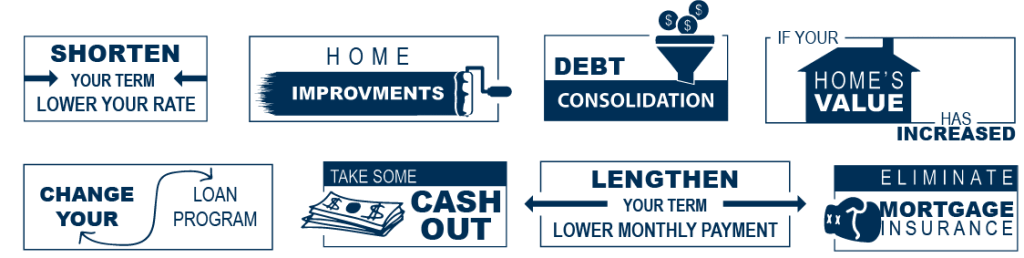

WHAT CAN REFINANCE DO FOR ME?

Refinances are undertaken by borrowers to take advantage of market conditions, adjust their monthly budget, limit their exposure during financial difficulty, simplify debt management, or gain a tax advantage in certain situations.

Lowering your Payments

Cash-Out Refinances

Cash-out refinances may not help lower your monthly mortgage payment or shorten your mortgage term, but additional cash is a useful resource. The equity (ownership) home buyers have established with their previous down payment and monthly mortgage payments can be retracted out of your home as currency for expenses. Many borrowers pull equity for home improvement, alleviating credit card debt and other debt consolidation. A cash-out refinance allows borrowers to see market value appreciation before the property is the sold. In some cases, when combined with a second mortgage, home buyers can refinance into a loan amount above traditional standards and keep the cash proceeds.

Home Equity Loans and

Lines of Credit

- Home Improvement: Improving a house can increase a home buyer’s overall quality of life, as well the home’s value. The increased value after renovation may be enough to offset the cost of the project.

- A second home: If a buyer is in the market for a vacation home or investment property, the equity in their current residence can be a good source of funds for a down payment and closing costs.

- Education: A home equity line of credit gives buyers the flexibility to pay for tuition, room and board, books, and other school related.

- Big events: Life is full of big events with big price tags. Whether home buyers are looking forward to a wedding, a new baby, or a family trip to Hawaii, home equity loans can make financing easier.

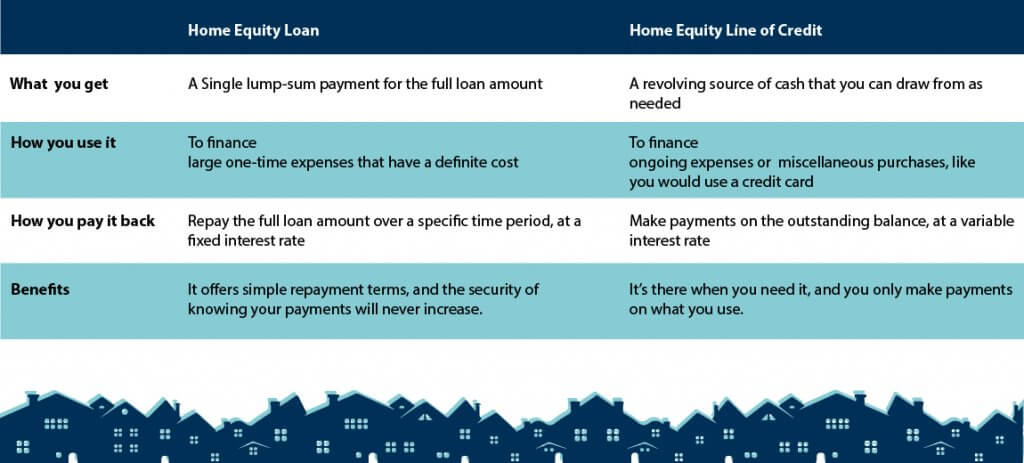

Comparing Home Equity Loans

and Credit Lines

First Time

Home Buyers

Starboard Financial holds a special place for first-time home buyers in our company philosophy. Giving first-time home buyers the advice and knowledge to make an informed home buying decision is one of our truest pleasures. They are the lifeblood of the mortgage business, and exemplify one of the core aspects for why we formulated Starboard Financial. We have a plethora of real estate resources to help home buyers navigate the mortgage process for their first home purchase. The loan process can be overwhelming; it is our job to relieve as much of the stress as possible. Please consult these resources for help in your journey:

Your Journey Starts Here

First Time Home Buyers Guide

First Time Home Buyers Guide

Finding YOUR Agent

Finding YOUR Agent

Veteran Options

- Because the VA Home Loan is a benefit home buyers earn through service to our country, the VA has relaxed credit qualifying standards compared to non-veteran loan programs, so even if you have a prior Bankruptcy and/or Foreclosure, home buyers should speak with a mortgage loan officer who can guide you through the loan approval process. Furthermore, Veterans who receive disability benefits from the VA are exempt from the VA Guarantee Fee and mortgage insurance. This can result in significant payment savings when compared to non-veteran loan programs. Starboard Financial also offers great interest rates on VA refinance loans to Veterans who already own a home. Whether you are looking to access existing equity in your property to obtain cash back at closing, or simply desire to lower your existing interest rate and monthly mortgage payment, Starboard Financial is here to serve all home buyers. Give us a call today.

Benefits of a

VA Loan

- No down payment*

- No cash reserves

- No application fee

- No monthly mortgage insurance premiums

- VA funding fee may be financed

- Minimum down payments available

- Zero down payment offered to disabled veterans

- No Private Mortgage Insurance Necessary

- No seller closing cost limitations

- Basic Allowance for Housing eligible for loan payments

- No early mortgage payment penalties

- 1-4 unit primary residences with restrictions

- VA assistance to veterans in default

- May pay off some consumer debt with the refinance loan program**

- Seller can pay certain closing costs thus decreasing the closing costs for the borrower

- VA Funding Fee can be financed into the loan amount for reduced up-front costs

- Benefits are Reusable

- Available to veterans, reservists, active-duty personnel, and surviving spouses of veterans, based on military entitlement

- *Up to 100% financing (based on VA lending limits) may be available for purchase loans and up to 90% for cash-out refinances. Gift funds or bond programs for closing cost assistance are allowed. **Please consult your financial advisor about the consolidation of short term debt into long term debt.

CONSTRUCTION LOANS

What is a Construction home loan?

- A short term loan used to finance the cost of building a home. They are reflective of the time needed to build a home; typically ranging from six months to a year.

Requirements For Construction Loans

- A notarized copy of the deed for the land you’re building on. If you’re buying the land, bring a copy of the purchase agreement.

- Plans & specifications

- Construction contract

- Federal Tax Returns (1040s) for the last 2 years

- Bank Statements from the last 2 months

- Most recent pay stubs

- W-2s from the past 2 years

- Call Starboard Financial for prequalification

What are the Benefits?

- Flexible construction terms available

- Simple builder approval process

- Interest-only payment during the construction phase

- Wide variety of long term loan programs to choose from

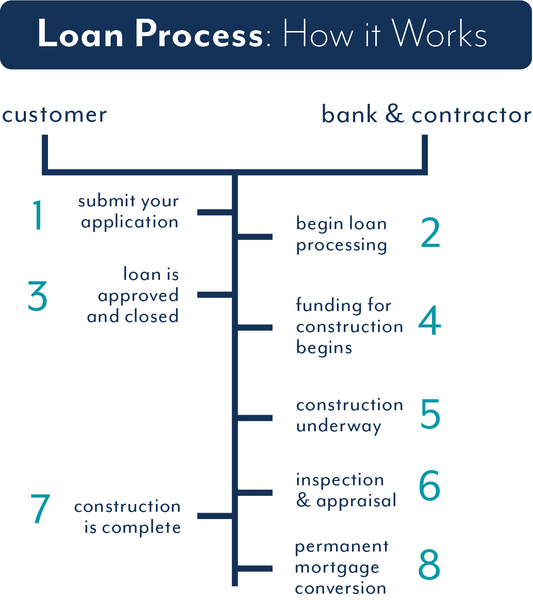

The Loan Process

The Starboard Financial Loan Process was built around the needs of our purchase clients.

Starboard Financial would like to share our efficient loan process with potential home buyers. The diagram below provides a quick summary. Additional information for each step is provided as well. If you have any questions or would like further clarity, please feel free to contact us for more information.

Appraisal Order

Loan Conditions

Appraisal Order

Loan Conditions

Please note that in a Refinance transaction, the Pre-Qualification and Accepted Contract stages will be omitted, otherwise the Purchase and Refinance loan processes are the same.

Corporate Office

(480) 897-9777

info@starboardfinancial.com

4145 E Baseline Rd, Gilbert, AZ 85234 | NMLS# 156931 NMLS Consumer Access